Alternatively, the credit would be to accounts payable if they paid on credit. On the other hand, the buyer will just record the purchase transaction as the shipping cost is not their responsibility. Freight-out is an expense account, in which its normal balance is on the debit side. Likewise, in this journal entry, the total assets on the balance sheet decrease while expenses on the income statement increase by the same amount of freight-out cost. If the freight classification is FOB destination, then the seller records the transportation cost as freight-out, transportation-out or delivery expense. FOB destination requires a debit to freight-in and a credit to accounts payable.

Under the periodic inventory system, the company can make the freight-in journal entry by debiting the freight-in account and crediting the cash account. Similarly, the company must make a freight-in journal entry by debiting the freight-in cost from the inventory account and crediting the cash account in this case. Freight-in is capitalized onto the balance sheet since it’s considered a production cost. Therefore, when freight-in is incurred, the company would debit inventory (freight-in) and credit cash (cash outflow to pay the expense). The other way to account for freight charges in the journal entry is to record them as a liability.

What is freight and example?

Said differently, it’s nothing but carriage inwards or carriage outwards. Carriage inward and carriage outward relates to purchase marginal cost formula and sale of goods, respectively. Paid freight journal entry records such shipping expenses in the books of accounts.

In this journal entry, the amount of the debit of the inventory account here is the purchase price of goods (including taxes) plus the transportation cost. The freight in account in the above journal entry is a temporary account that adds to the cost of goods purchased. This account will be cleared at the end of the accounting period when we calculate the cost of goods sold. You will notice that the transaction from January 3 is listed already in this T-account. The next transaction figure of $4,000 is added directly below the $20,000 on the debit side. This is posted to the Unearned Revenue T-account on the credit side.

Is freight a direct expense?

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Once the goods are at the buyers destination, the ownership of the goods and the risk passes to the buyer. Having decided that the terms of the contract are FOB, it is now necessary to choose the point at which responsibility passes from the seller to the buyer. The FOB point can either be the buyers destination, or the place from which the goods are shipped – the shipping point.

Saudi Arabia Freight and Logistics Market [REVENUE SOURCE … – Digital Journal

Saudi Arabia Freight and Logistics Market [REVENUE SOURCE ….

Posted: Tue, 29 Aug 2023 07:46:03 GMT [source]

The method of payment should be clearly specified in the FOB destination terms and conditions. A number of factors can influence the cost of shipping goods, including fuel costs, demand for freight services, emerging events, and government regulation. Note that Figure 6.10 considers an environment in which inventory physical counts and matching books records align. This is not always the case given concerns with shrinkage (theft), damages, or obsolete merchandise.

What if there is any income tax deductible at the source (TDS on Transportation)?

At the buyers destination, the buyer has not yet incurred any freight but owes the seller for the goods. And if the buyer uses the perpetual inventory system, it will be the debit of the inventory account instead. Likewise, the transfer point is when goods arrive at the buyer’s location. So, the seller will bear all the risks that could happen to goods being delivered until they reach the customer’s location. The definition of freight is cargo or goods transported by truck or other means of transportation, or the amount you are charged to transport goods.

- Journal entry is to debit the freight and credit the payable account.

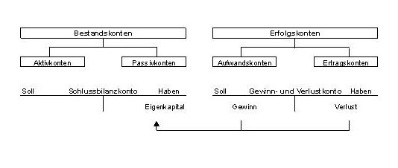

- How do we know on which side, debit or credit, to input each of these balances?

- The record is placed on the credit side of the Accounts Receivable T-account across from the January 10 record.

- It is a good idea to familiarize yourself with the type of information companies report each year.

- Freight charges can be handled in much the same way as other general business expenses.

Freight accruals are a method of tracking and calculating shipment costs that haven’t yet been billed. Most companies accrue through setting an estimate, along with a buffer to account for variances. Then they wait for invoices to arrive, and compare estimates versus actual costs in order to settle payments. $$$ Similar to the purchase account, the freight-in account is a temporary account that will be cleared at the end of the accounting period when the company makes the cost of goods calculation.

Discussion and Application of FOB Destination

Merchandise Inventory increases (debit), and Cash decreases (credit), for the entire cost of the purchase, including shipping, insurance, and taxes. On the balance sheet, the shipping charges would remain a part of inventory. Freight-in only flows through cost of goods sold when inventory is sold and revenue is recognized. The freight-in journal entry can be made using the periodic inventory system by debiting the freight-in account and crediting the cash account. Likewise, the transportation cost will include in the journal entry for FOB shipping point on the buyer’s side.

Additionally, if the freight charges are paid with cash or credit, the journal entry should also record the payment. Accountants typically label the charges as either FOB shipping point or FOB destination. FOB stands for “freight on board.” FOB shipping point requires the buyer to pay freight charges. FOB destination means the seller must pay the charges for shipping the assets.

The following are selected journal entries from Printing Plus that affect the Cash account. We will use the Cash ledger account to calculate account balances. It is a good idea to familiarize yourself with the type of information companies report each year. Peruse Best Buy’s 2017 annual report to learn more about Best Buy. Take note of the company’s balance sheet on page 53 of the report and the income statement on page 54.

Accounting Ratios

Gift cards have become an important topic for managers of any company. Understanding who buys gift cards, why, and when can be important in business planning. This is posted to the Accounts Receivable T-account on the debit side. This is posted to the Service Revenue T-account on the credit side. This is posted to the Accounts Payable T-account on the credit side.

Likewise, we record this to the purchases account only when the buyer uses the periodic inventory system. This is posted to the Cash T-account on the credit side beneath the January 14 transaction. Accounts Payable has a debit of $3,500 (payment in full for the Jan. 5 purchase). You notice there is already a credit in Accounts Payable, and the new record is placed directly across from the January 5 record. Another example is a liability account, such as Accounts Payable, which increases on the credit side and decreases on the debit side. If there were a $4,000 credit and a $2,500 debit, the difference between the two is $1,500.

Prerequisites for Paid freight journal entry

On the seller’s side, we can make the journal entry for FOB shipping point by debiting the accounts receivable or cash account and crediting the sales revenue account. As mentioned, under the perpetual inventory system, the company needs to record the freight-in cost as a part of the inventory cost. Likewise, the company needs to make the freight-in journal entry in this case, by debiting the freight-in cost into the inventory account and crediting the cash account. While the firm pays for the transportation when making a sale, the freight-out journal entry may be made by debiting the freight-out account and crediting the cash account. Shipping is determined by contract terms between a buyer and seller. There are several key factors to consider when determining who pays for shipping, and how it is recognized in merchandising transactions.